are inherited annuities tax free

An annuity is a financial product that can be passed down from one generation to another. Annuity Owner Dies before the age.

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Spouses have more control over changing the terms of inherited annuities.

. That means you dont pay taxes on the funds while they grow. You live longer than 10 years. Tax Consequences of Inherited Annuities.

Different tax consequences exist for spouse versus non-spouse beneficiaries. When someone dies their estate is typically divided among their heirs. If you do not like the features of an annuity you can trade it for.

So the person who inherited the annuity can receive a guaranteed lifetime that will also spread out the tax liability. The money from an inherited annuity can be paid out as a single lump sum which becomes taxable in the year it is received. C Elect within 60 days to.

If you are one of the lucky people who inherit money or property you may wonder if you must pay taxes on it. Others Taxation of inherited annuities is different for spouses and non. Surviving spouses can change the original contract.

Annual payments of 4000 10 of your original investment is non-taxable. The money from an inherited annuity can be paid out as a single lump sum which becomes taxable in the year it is received. When you inherit an annuity the tax rules are similar to everything described above.

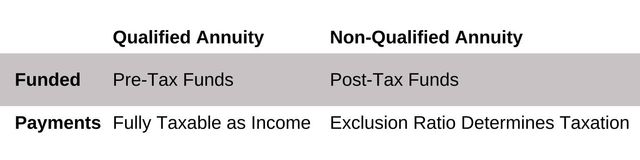

Instead you pay taxes later when you receive the funds. If a non-qualified annuity is annuitized then a portion of the. Much like taxes annuities just arent very popular.

As someone other than the surviving spouse you will basically have three potential options. The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. You have an annuity purchased for 40000 with after-tax money.

Are Inherited Annuities Tax Free. Payments can be spread. These payments are not tax-free however.

Inherited Annuity Tax Implications. Taxes owed on an inherited annuity will depend on the payout structure and the status of the beneficiary. You may also have to pay fees to.

If you inherit an annuity you may have to pay taxes on your money. The rules concerning tax-free exchanges of non-qualified annuities changed in 2013 when the Internal Revenue Service. Lets look more closely at the key tax rules on inheriting a non-qualified annuity.

Are Inherited Annuities Tax Free. Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account. The money from an inherited annuity can be paid out as a single lump sum which becomes taxable in the year it is received.

A 1035 exchange allows nonqualified annuities to be exchanged for another nonqualified annuity tax-free. B Full payout over the next five years. The taxation of any annuity which has been inherited by a beneficiary will be dictated by the age of the original owner upon their death.

Non-qualified annuities can be exchanged tax-free. Qualified annuity distributions are fully taxable. No one likes paying taxes to Uncle Sam and a mere 17 of American households led by someone between 40 and 85 owns.

Can An Inherited Non Qualified Annuity Be Rolled Over Without Tax

Fixed Annuities And Taxes Match With A Local Agent Trusted Choice

Leaving Nonqualified Annuity For Child Will She Owe Tax

What Is The Best Thing To Do With An Inherited Annuity Due

How To Avoid Paying Taxes On An Inherited Annuity By Jenniferlangfinancialservices Com Youtube

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

Annuity Taxation How Various Annuities Are Taxed

Annuity Taxation How Are Annuities Taxed

Pass Money To Heirs Tax Free How To Avoid Taxes On Inheritance

How Are Annuities Taxed Safemoney Com

Annuity Beneficiaries Inheriting An Annuity After Death

Tax Rules For An Inherited Nonqualified Annuity

How Are Annuities Taxed In Retirement How To Reduce Taxes

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Inheritance Annuities Know Your Annuity Contract Transamerica

Annuity Tax Consequences Taxes And Selling Annuity Settlements

What Is The Tax Rate On An Inherited Annuity